Are you just starting out on your business journey or already scaling your enterprise?

A solid financial strategy is fundamental to navigating various stages of business development, particularly during economic downturns, says industry leaders across segments

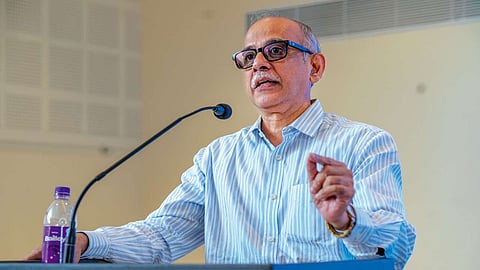

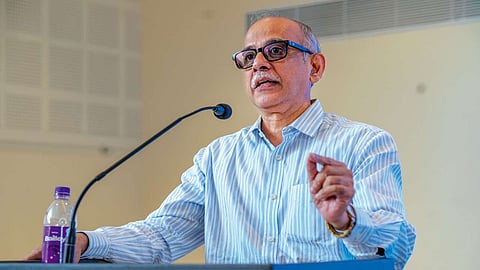

“In today’s complex business environment, financial planning plays a crucial role in the survival and growth of small businesses,” V. Sathyanarayanan, Joint Managing Partner of Varma & Varma, Chartered Accountants told young entrepreneurs who had gathered at an MSME summit in Kozhikode recently.

“At the start-up phase, having vision, wisdom, and common sense is essential. Successful entrepreneurs often rely more on practical wisdom and risk-taking than formal education. As discussed by experienced business leaders, understanding key aspects such as capital requirements, profit margins, and financial challenges is critical,” Sathyanarayanan said.

No business works in a vacuum, and understanding the competitive landscape is vital for success. His advice to young entrepreneurs? “Knowing your competitors and their performance helps you position your business to outperform them.”

A detailed business plan serves as a roadmap for success. It provides clarity on the legal structure of your business, whether it's a sole proprietorship, partnership, or private limited company.

Each structure comes with its own implications for growth, taxation, and governance, so seeking professional advice is highly recommended.

“Importance of a suitable capital structure is crucial,” Sathyanarayanan said.

“Balancing debt and equity ensure that your business is neither over-leveraged nor too conservative, both of which could stifle growth or lead to financial strain,” he added.

Once your business enters the growth phase, financial discipline becomes even more critical. A comprehensive budgeting exercise—covering cash flow, revenue, and capital expenditure—is essential.

Regularly comparing actual performance against your budget helps you find areas for improvement and prevent financial mismanagement.

Proper working capital management is another pillar of a healthy business. Mismanagement can lead to significant cash flow issues, as exemplified by businesses that do not collect receivables on time, thereby incurring unnecessary loans.

Business owners were also cautioned against borrowing from informal sectors due to the high interest rates that could erode profitability.

“Depending on informal sources can lead to financial crises,” said Royson Francis, Head, Business Development Channel, Muthoot Fincorp.

Good governance is essential for long-term sustainability. Filing taxes and financial reports on time not only ensures compliance but also strengthens your reputation and ability to secure formal funding.

Sathyanarayanan pointed out the example of Kochouseph Chittilappilly, Chairman Emeritus of V-Guard Industries who was recognised as the best taxpayer in Kerala.

“Even after paying income tax at the rate of 30%, he [Kochouseph Chittilappilly] was awarded as the best taxpayer in Kerala. So, even after paying tax, you can become big and grow to that size,” Sathyanarayanan said.

Experts said robust internal controls can help reduce the risk of fraud, a reality in every organisation.

Growing businesses often face challenges such as fear of expansion and reluctance to change established systems.

Overcoming these hurdles requires confidence in your ability to manage larger operations and the flexibility to innovate. Implementing an effective management information system (MIS) can also offer prompt insights into key performance metrics, helping you make informed decisions.

As businesses mature, diversification becomes a potential growth strategy. However, diversification should be a well-thought-out decision, supported by thorough research into the new market and competitors. Innovation, rather than mere replication of competitors’ actions, is crucial for staying ahead.

Businesses facing challenges must focus on cost reduction to improve profitability. Segmenting your operations geographically or by product line can help find loss-making areas and allow you to take corrective action.

Reducing fixed costs and turning them into variable expenses, such as performance-linked salaries, is another strategy to enhance financial flexibility.

Additionally, understanding your business’s cash conversion cycle and managing capital requirements effectively can prevent cash flow problems during tough times.

“Nowadays, banks are more willing to lend to large institutions. However, when Dhirubhai Ambani started his business, he would never have gotten a loan. So, it is important to take on capital when you need it,” Sathyanarayanan rounded off.