India’s most significant direct tax reform in over six decades moved a step closer to becoming law on Monday, as the Select Committee of the Lok Sabha submitted its report on the draft Income Tax Bill, 2025. While broadly endorsing the government’s aim to simplify the tax code, the panel recommended several changes to address ambiguities, protect taxpayer rights, and ensure regulatory continuity.

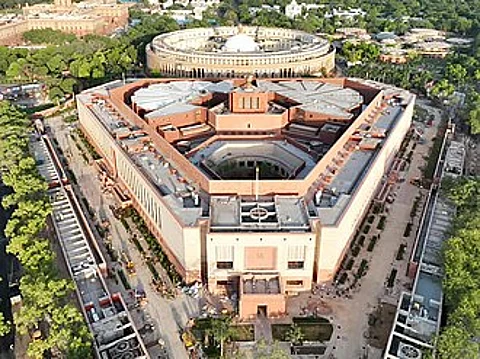

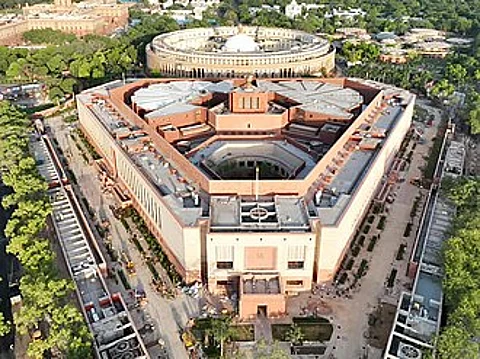

The report, tabled by committee chairperson Baijayant Panda, a Bharatiya Janata Party (BJP) MP, comes a few months after the finance minister, Nirmala Sitharaman, introduced the bill in Parliament in February. The proposed legislation seeks to replace the Income Tax Act of 1961, which has underpinned India’s direct tax regime for over 60 years.

While welcoming the bill’s stated intent to streamline tax administration, the 32-member panel flagged several concerns and technical inconsistencies, warning they could dilute taxpayer safeguards or raise the compliance burden if not rectified.

Among its principal recommendations, the committee called for clarifying important definitions—such as capital asset, infrastructure capital company, and parent company—to align them with existing laws and eliminate outdated references.

It also urged harmonisation of definitions for micro and small enterprises with the MSMED Act, and sought clearer rules for deductions related to house property income, scientific research, and pension contributions.

A drafting anomaly was identified in the rebate clause for individuals earning above ₹12 lakh, with the panel recommending revised wording to prevent misinterpretation.

To safeguard taxpayer rights under the General Anti-Avoidance Rules (GAAR), the committee proposed reinstating the phrase “in the circumstances of the case”—an important qualifier that ensures enforcement is context-sensitive and not arbitrary.

It also opposed the blanket disallowance of deductions for late filers and supported retaining flexibilities such as the “deemed application” of income for non-profit organisations. The panel urged more precise rules for taxing religious and charitable trusts and anonymous donations to minimise ambiguity.

A key recommendation was to explicitly carry forward all valid circulars, approvals, and exemptions under the Income Tax Act, 1961 into the new regime. The committee also advised easing compliance for non-residents and codifying standards for valuer qualifications and jurisdictional limits.

The panel emphasised the need for a smooth yet cautious transition to the new law. It suggested revising Clause 536, which repeals the 1961 Act, to clearly preserve operational continuity and prevent disruption.

Other technical recommendations included restoring the term “Nil” in clauses on lower tax deduction certificates, and correcting vague language concerning deductions and refund eligibility.

The committee highlighted the risk of prosecution in cases where individuals below the taxable income threshold are nonetheless required to file returns solely to claim refunds.

“The Committee observed that the current mandatory requirement to file a return solely for the purpose of claiming a refund could inadvertently lead to prosecution, particularly for small taxpayers whose income falls below the taxable threshold but from whom tax has been deducted at source,” the report noted.

It recommended allowing flexibility for refund claims in such cases even when returns are not filed within the stipulated timeframe.

For non-resident liaison offices, the panel proposed extending the timeline for filing compliance statements from 60 days to eight months, citing practical difficulties faced by overseas entities.

With the committee’s report now submitted, the finance ministry will review the recommendations before finalising the bill for parliamentary passage. Given the extent of the changes suggested, some revisions are expected before the bill becomes law.

Quoting the statement of objects and reasons, Panda said said the new Income Tax Bill 2025 aims to make the law concise, lucid, and easier to understand.

(By arrangement with livemint.com)