The Open Network for Digital Commerce (ONDC), an interoperable network initially launched by the government to increase e-commerce penetration in the country, will soon offer sachetised insurance and investment products.

This comes after the company on August 22 debuted in the financial services sector offering digital and paperless loans in just six minutes to both salaried and self-employed individuals, through its network of nine service providers and three lenders.

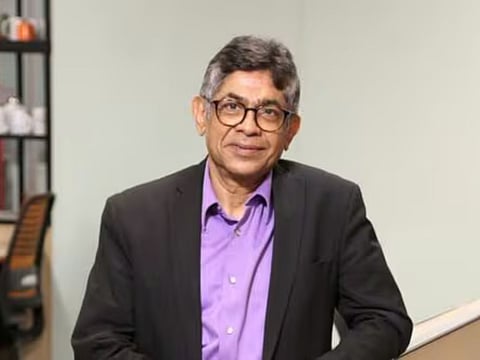

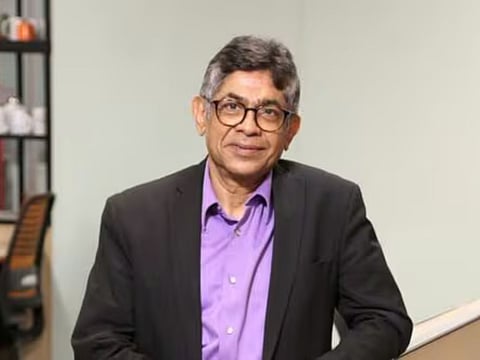

Thampy Koshy, the managing director of ONDC, told Mint that the network will start offering other financial services like insurance and micro-investments, on its network soon. “Within (general) insurance, we have already done trial transactions. We will do a few more and then we will make it public,” he added.

Mr Koshy also said that the network will follow that by offering micro-investment products like mutual funds within the next quarter.

ONDC has begun transactions in health and marine insurance already, according to a person in the know. In addition, it has started developing a protocol for life insurance products and expects to initiate transactions by December.

It was reported earlier that ONDC planned to offer auto, health, and marine insurance, and mutual fund products. ONDC is now planning to launch the services within this year.

The company is also expected to make its first mutual fund transaction by September. ONDC will most likely launch these services officially once it cross 100 transactions each.

“We started with one segment (unsecured loans) and only a few stock-keeping units (SKUs) within that. Even when we started food, it didn't have variants, now you can have all kinds of variety, that is how we expand. Eventually, every product or service that is cataloguable will be there,” Mr Koshy told Mint.

Meanwhile, within lending, ONDC Network plans to introduce goods and services tax (GST) invoice financing loans by September. The network will also include purchase financing for individuals and sole proprietors, and working capital lines for partnerships and private limited companies, within its lending services soon.

Through this foray, buyer applications on the ONDC Protocol will have access to multiple lenders with a single integration. So far, ONDC has buyer applications like Paisabazaar, Tata Digital, Easypay, and Invoicepe, among others, and lenders like Aditya Birla Finance, DMI Finance, and Karnataka Bank, integrated into its network.

ONDC said that it also has a strong pipeline of buyer applications with an interest in expanding this digital credit model, such as Mobikwik, Rupeeboss, and Samridh.ai. Similarly, HDFC Bank, IDFC First Bank, and Central Bank of India are among the lenders in the queue to join the ONDC network.

“For bigger players, there is no urgent need initially because they are established. But when they find that the network has become relevant for their use case, more such firms will follow,” said Mr Koshy.

ONDC's expansion into financial services coincides with a broader trend of e-commerce companies exploring various avenues to enter the financial services sector. On August 21, Zomato bought Paytm’s entertainment and ticketing business for $244 million.

On the same day, Flipkart rolled out a new payments app, super.money, to enable users to make payments via Unified Payments Interface (UPI) and earn cashback, rekindling its ambition to gain a stronghold in the fintech space. “While those are one-to-one deals, with ONDC options increase both for the supplier and consumer,” said Mr Koshy.

(By arrangement with livemint.com)