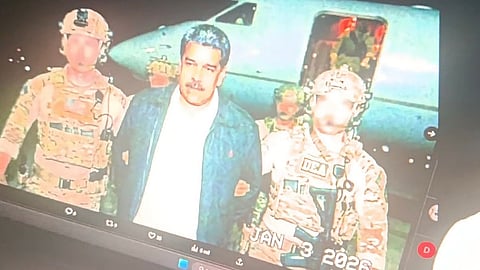

The United States’ dramatic capture of Venezuelan President Nicolás Maduro has sent shockwaves through global politics, triggering sharp reactions from Russia and Europe while raising fresh questions about sovereignty, international law and energy markets.

The global economy is expected to feel the heat and stock markets across the world are likely to reflect the impact. The immediate impact has been felt in energy markets. Venezuela holds the world’s largest proven oil reserves, and uncertainty over leadership has pushed oil prices higher amid fears of supply disruption. US refiners with limited access to Venezuelan crude are watching developments closely, while Asian and European buyers brace for volatility.

According to US officials, Maduro was taken into custody during a covert operation outside Venezuela, following years of sanctions, criminal indictments and allegations of drug trafficking and human rights abuses. Washington described the move as a “law enforcement action” rather than a regime-change operation, stressing that it acted under existing US court warrants. However, the unprecedented detention of a sitting head of state has immediately deepened global fault lines.

The immediate impact has been felt in energy markets. Venezuela holds the world’s largest proven oil reserves, and uncertainty over leadership has pushed oil prices higher amid fears of supply disruption. US refiners with limited access to Venezuelan crude are watching developments closely, while Asian and European buyers brace for volatility.

Russia reacted with fury, condemning the capture as “an act of international piracy” and a direct violation of Venezuela’s sovereignty. The Kremlin accused Washington of dismantling global norms for political convenience and warned of “serious consequences” for international stability. Moscow has long backed Maduro diplomatically and economically, seeing Caracas as a strategic counterweight to US influence in Latin America. Russian officials signalled that energy cooperation, military coordination and diplomatic retaliation were all under review.

European responses were more cautious but deeply divided. The European Union stopped short of endorsing the US action, calling instead for clarity on the legal basis of the arrest and urging restraint.

The episode risks reshaping global diplomacy. Analysts warn that the capture of Maduro may set a dangerous precedent, emboldening powerful nations to bypass international institutions. As Russia hardens its stance and Europe struggles to balance principle with pragmatism, the world is left grappling with the long-term consequences of a move that has redrawn the boundaries of power politics.

The global economic fallout from the capture of Nicolás Maduro has been swift, with energy markets and stock exchanges reacting nervously to the surge in geopolitical risk. Oil prices jumped sharply as traders priced in the possibility of supply disruptions from Venezuela, home to the world’s largest proven crude reserves, and a potential escalation involving Russia, a key global energy supplier. Brent crude briefly rose more than 4 percent in early trading before paring gains, while volatility indicators in oil markets spiked to multi-month highs.

Equity markets reflected a classic risk-off response: major indices in the US and Europe slipped as energy stocks gained but airlines, manufacturing and emerging market funds came under pressure. Investors also moved into safe-haven assets, pushing up gold prices and strengthening the dollar, which added further strain on emerging market currencies. Analysts warned that prolonged uncertainty could keep energy prices elevated, feeding into global inflation at a time when central banks are still cautious about easing monetary policy, thereby increasing the risk of slower growth and renewed market turbulence.