A long-awaited trade pact between India and the United States appears close to fruition, but politics on both sides may once again delay its announcement. Negotiators have reportedly agreed in principle to reduce the steep 50 percent tariffs imposed by Trump on Indian goods to around 15–16 percent. However, upcoming elections in both countries — and the personal calculations of their leaders — are complicating the timing, a South China Morning Post analyst claims.

According to people familiar with the discussions, Washington is keen to conclude the deal quickly to placate American farmers affected by trade frictions with China ahead of the 2026 midterm elections. New Delhi, however, has been reluctant to make any announcement before the crucial Bihar elections in November, fearing political backlash in a state that produces both corn and soybeans.

Officials had initially hoped to unveil the first phase of the deal during a planned meeting between Trump and Prime Minister Narendra Modi on the sidelines of the ASEAN summit in Malaysia from October 26–28. But with Modi expected to join virtually and Foreign Minister Subrahmanyam Jaishankar leading the delegation, the announcement now appears unlikely.

Sources also said both sides were wary that a sharp tariff cut for India might upset Malaysia, the ASEAN host, which after prolonged negotiations with Washington secured only a reduction to 19 percent. Indian Commerce Minister Piyush Goyal said progress was being made and described the deal as “fair and equitable”, likely to be concluded soon.

The talks represent a crucial test of the Trump administration’s broader Indo-Pacific strategy — rebuilding trade ties with India while increasing pressure on both China and Russia. Any agreement could reset one of Washington’s most important but often tense economic relationships, though domestic politics continue to complicate progress.

Sources said that purchases of US energy and agricultural products, including soybeans and corn, are expected to form the backbone of the agreement. With China having cut off American soybean imports — previously accounting for around 40 percent of US sales — Trump has been pressing other nations to fill the gap.

Analysts noted that Modi’s absence from the ASEAN summit made an immediate announcement unlikely. Observers in Washington suggested that if key elements were already finalised, both sides might seek another opportunity, possibly during a future Trump visit to India.

Policy experts argued that the lack of long-term India specialists in the Trump administration made it harder to grasp India’s sensitivities, especially regarding agricultural market access, and that such understanding required direct engagement from senior officials close to the president.

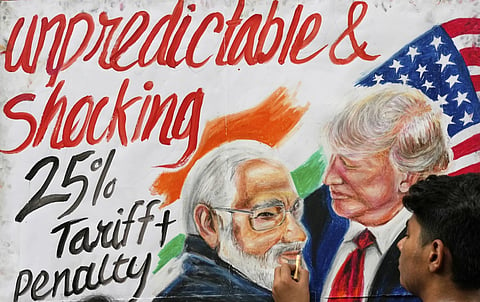

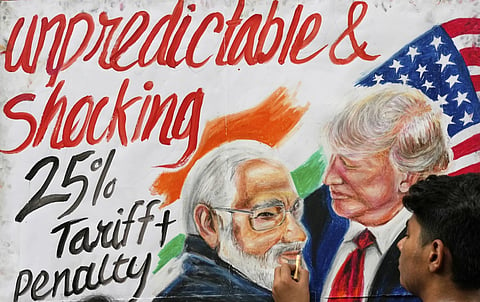

India, one of the countries most affected by the Trump tariffs, has indicated willingness to boost imports of US soybeans and corn in exchange for lower duties on its exports. But Trump’s decision to impose an additional 25 percent duty as a “penalty” for India’s continued purchase of Russian oil has complicated matters.

The US president recently claimed that India was reducing its dependence on Russian energy and would “be down to almost nothing” by the end of the year, asserting that Modi had personally promised to halt such imports. Indian officials denied that any such assurance was given, saying instead that the country was gradually diversifying its energy sources to meet the needs of its vast population.

Data shows that India imported around 1.7 million barrels per day of Russian crude during the first nine months of this year — roughly in line with 2024 levels.

Despite the personal rapport between Trump and Modi, the negotiations have remained rocky. The US has pushed for greater access to India’s agricultural markets — a politically sensitive area where more than 40 percent of Indians depend on farming for their livelihoods, compared to about 3 percent in the US.

Observers believe Modi will establish safeguards to protect Indian farmers from a potential surge in American agricultural imports. Political sensitivities, voter backlash and the weight of the farm lobby are seen as major hurdles.

Experts close to the talks said India understood that some concessions were necessary to secure an agreement acceptable to Trump and his team, while also managing the domestic fallout.

Trade analysts described the recent progress as encouraging but warned that Trump’s combative rhetoric towards India could leave a lasting impact. They noted that while lower tariffs could help reset relations, recent tensions may take longer to heal.

Other observers pointed out that despite recent frictions, Trump had historically maintained a workable relationship with India. They said that economic collaboration and shared security interests created a foundation of trust not easily replicated by other powers such as China.

Still, some cautioned that the US had eroded goodwill in New Delhi in recent months. Even a limited “first-phase” trade pact, they said, could serve as a vital confidence-building measure.

Analysts also suggested that Washington recognised the strategic importance of avoiding punitive trade actions against partners like India, warning that such moves could push them closer to Beijing’s orbit — an outcome neither side desires.