Nvidia, the world’s most valuable company and the undisputed engine of the global AI boom, has once again delivered earnings that Wall Street — and global markets — were anxiously waiting for.

With tech valuations wobbling in recent weeks, investors had been looking to Nvidia to signal whether the massive surge in AI spending still had legs. The chip-maker did not disappoint. Its latest numbers not only smashed expectations but also reassured markets that AI investment momentum remains intact, despite concerns of a bubble.

For Indian investors tracking global tech trends, the update is significant. Domestic IT majors, cloud providers and data-centre operators have been stepping up AI infrastructure spending, and Nvidia’s performance often serves as an indicator of how far this cycle can run.

In the quarter ended October, Nvidia posted revenue of $57 billion — a 62 percent jump — powered largely by unrelenting demand for its AI data-centre chips. Sales from that division alone surged 66 percent to more than $51 billion.

The company forecast fourth-quarter revenue of around $65 billion, well ahead of analyst estimates, pushing Nvidia shares up about 4 percent in after-hours trade.

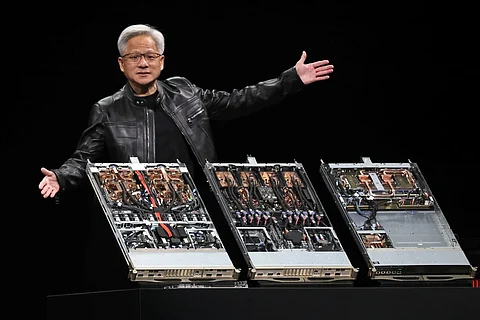

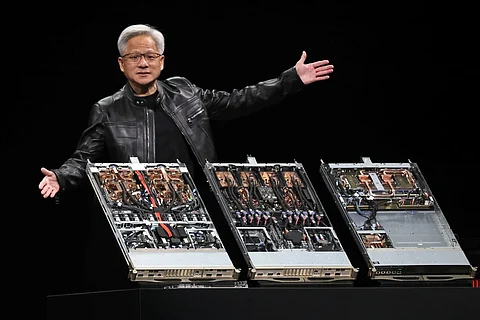

Chief executive Jensen Huang said demand for its latest AI Blackwell systems was “off the charts”, adding that cloud GPUs were sold out. “There’s been a lot of talk about an AI bubble. From our vantage point, we see something very different. We excel at every phase of AI,” he told analysts.

Nvidia’s update came at a tense moment for global markets. Concerns over overstretched AI valuations had triggered four straight days of losses on the S&P 500, which is down nearly 3 percent so far this month. With so much riding on Nvidia’s performance, analysts said the question was not whether it would beat expectations, but by how much.

Some strategists believe certain pockets of AI have overheated, but Nvidia — positioned at the centre of AI infrastructure — continues to defy those concerns.

Earlier this year, Huang had said he expected $500 billion worth of AI chip orders through next year. Investors were keen for clarity on when these orders will translate into revenue. Chief financial officer Colette Kress said Nvidia would “probably” take even more orders beyond the $500 billion already announced.

She, however, flagged frustration over US export restrictions that curb Nvidia’s ability to sell high-end chips to China — a key market for AI developers. “The US must win the support of every developer, including those in China,” she added, noting the company remains engaged with both governments.

Huang also joined Elon Musk on Wednesday to unveil a massive Saudi Arabian data-centre complex that will deploy hundreds of thousands of Nvidia chips. Musk’s AI venture, xAI, will be the first customer.

Meanwhile, the Wall Street Journal reported that the US Commerce Department has approved the sale of up to 70,000 advanced AI chips to state-backed firms in Saudi Arabia and the UAE, reversing an earlier decision. The move followed White House talks between President Donald Trump and Saudi Crown Prince Mohammed bin Salman.

The broader tech sector is deepening its AI bets. Recent earnings from Meta, Alphabet and Microsoft confirmed the massive capital being poured into data centres and AI chips. Google chief Sundar Pichai even warned of pockets of “irrationality”, despite calling it an “extraordinary moment” for the industry.

Nvidia sits at the nexus of this global AI ecosystem, powering the ambitions of OpenAI, Anthropic and Musk’s xAI. The interlinked nature of these partnerships — including Nvidia’s $100 billion investment in OpenAI — has drawn scrutiny for creating a circular web of AI backers funding one another.

For India, where data-centre capacity is doubling and domestic firms are racing to adopt generative AI, Nvidia’s trajectory remains a crucial signal. For now, at least, the chip giant’s message to global markets is clear: the AI boom has plenty of fuel left.